Money Tokenization built on blockchain just got an enormous boost as we announce the launch of Pravica’s S3 (Stablecoin Studio on Sui) testnet during the CV Summit Africa 2024. Less than two months after publicising the launch of S3.Money on the Sui Blockchain, we are now up and running, welcoming developers and financial community to start building tokenized money whether CBDCs (Central Bank Digital Currencies) or stablecoins on our testnet.

The S3 platform is set to revolutionize the global payment processing landscape by allowing money to be tokenized in a versatile and user-friendly way swiftly and securely.

The premise is financial empowerment with blockchain based money tokenization, because the future of money is all about innovation and accessibility.

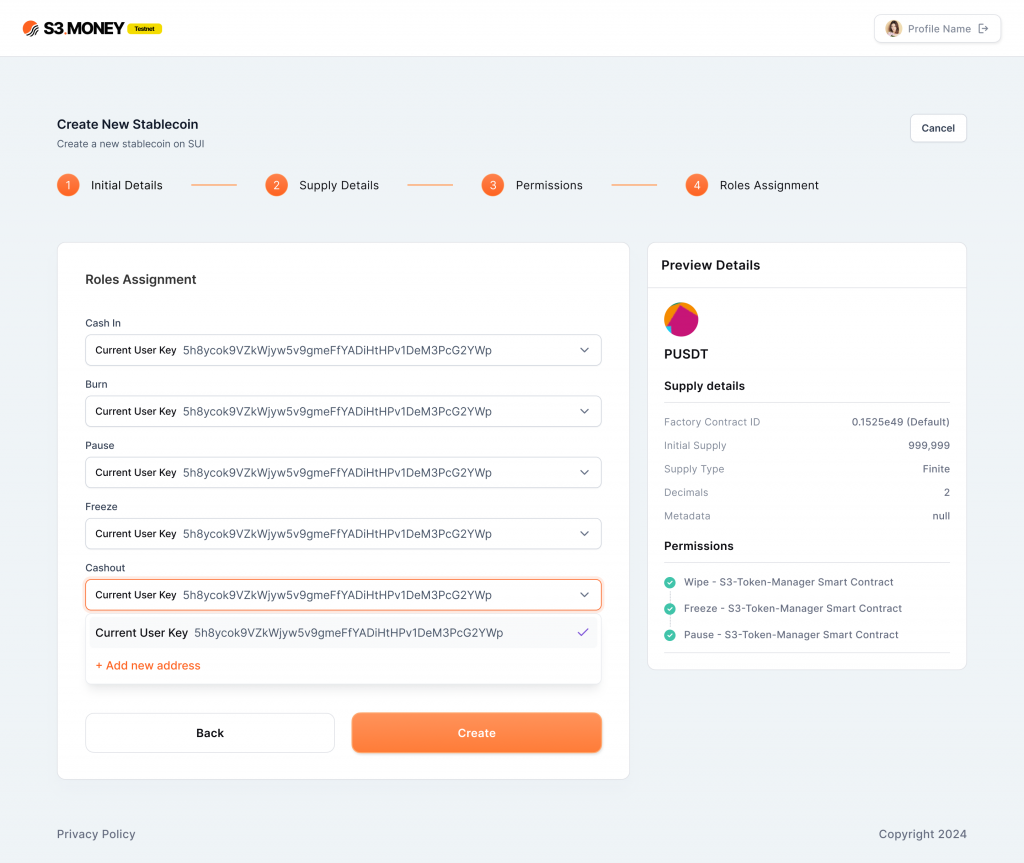

Mohamed Abdou Founder and CEO of Pravica, explaining the concept states, “With S3, issuing and managing CBDC or stablecoins are a matter of clicks!”

S3 Money is a solution that caters not only to up and coming stablecoin issuers such as central banks, retail banks, and DeFi (Decentralized Finance) projects, but also caters to existing stablecoin issuers including the creators of Tether (USDT), Circle (USDC) by offering them the ability to simplify, quickly issue, manage and create different treasury layers for their respective stablecoins.

Gone are the days of building and auditing smart contracts, S3’s innovation solution on Sui, bring stablecoins to life through a streamlined process of stablecoin issuance just by defining the parameters.

But the innovation doesn’t stop here, S3 also helps to maintain the stablecoin ecosystem through S3’s intuitive management dashboard. The dashboard monitors supply and demand in real-time, tracking transactions easily and allowing for adjustments along the way.

We have also introduced a groundbreaking feature called ‘Relations’, which allows clients to establish a secure, multi-layered hierarchy for sub-wallets within a client’s stablecoin ecosystem. Imagine creating permissioned access structures for different user groups, or designating sub-wallets for specific departments within your organization.

Finally, all this is done with compliancy at its heart. The platform enhances treasury command with built-in proof-of-reserve functionality and seamless integration with on-chain oracles. Integrated KYC/AML features prioritize compliance, strengthening due diligence with qualified identity verification services.

All this has been enabled because S3 leverages the secure and blazing-fast Sui blockchain for unparalleled stability and transaction speed.

The one-stop streamlined experience is unparalleled because of the intuitive capable administration with role-based controls, that allow the effortless configuration and management of tokenized money.

As Abdou explains, “Based on the adoption we are already seeing and our deep experience with international payment systems, we are convinced that stablecoins will revolutionize the global payments industry.”

So, join us in revolutionizing how money is created, managed and used in the digital age as we revolutionize the global payment processing landscape together!