When Tether co-founder William Quigley noted that tokenizing money is the greatest innovation after fiat, it was music to Pravica’s ears. This is especially true given that stablecoins are one step away from becoming an interest yielding digital asset, under a new term, tokenized fiat.

This is why we at Pravica have already jumped on the bandwagon and launched Pravica’s S3.Money (Stablecoin Studio on Sui) testnet during the CV Summit Africa 2024.

But it’s not only Tether that is bullish on stablecoins, Ripple is too, with its announcement that it will also enter the stablecoin market. These companies and traditional financial institutions are exactly the clients that Pravica caters to. Even Lightning Labs is building functionality to bring stablecoins and tokenized assets to Bitcoin. This could allow financial institutions to issue gold assets, stablecoins, and other fiat-backed assets on Bitcoin.

In the next 10 years, most of the global economies will transition to tokenized money, whether stablecoins or CBDC (Central Bank Digital Currencies).

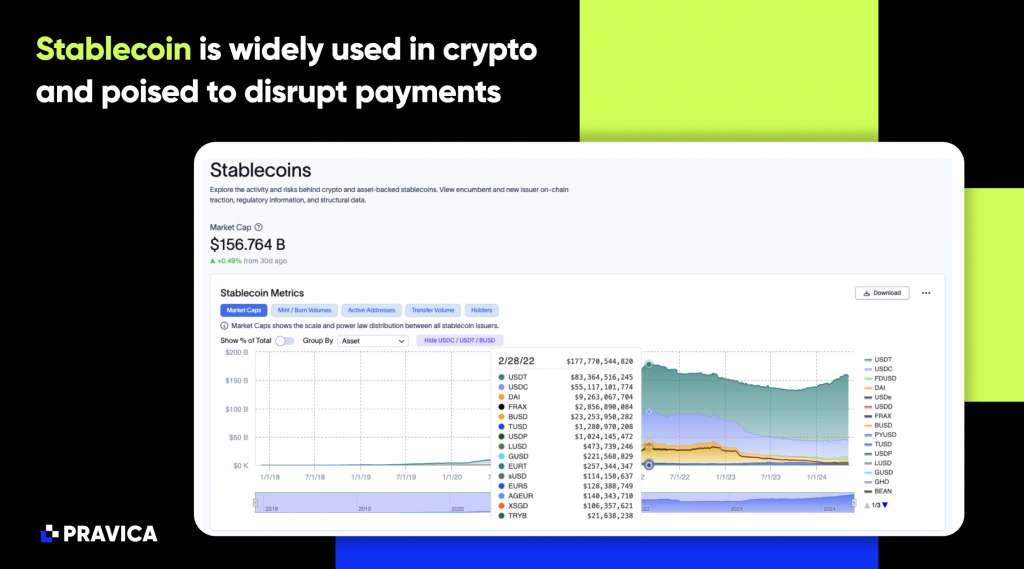

This is because stablecoins are connecting the traditional financial systems with the Web3 economy. Institutional investors, attracted by the lucrative $150 trillion payments sector, have played a significant part in driving the rapid growth of the stablecoin industry. The total value of all stablecoins in circulation could reach US$2.8 trillion by 2028, analysts at Bernstein predicted last year

Already, the stablecoin market is worth $156 billion, led by the top three stablecoins, USDT, USDC, and DAI. The market size is expected to grow even further. Galaxy Research, published in January of this year, noted that yield bearing offerings will become the new norm for stablecoins. MakerDAO led demand for yield-bearing stablecoins, which now represent over $2bn after starting the year at near-zero levels. Other offerings, such as Prisma Finance’s mkUSD and Lybra Finance’s eUSD use a variety of strategies to pass yields to token holders.

The research adds that other over collateralized stablecoins may resurge as DeFi activity picks up and the risk of appetite returns.

But stablecoins are not just an offering for Web3 players, we are seeing the PayPals of the world offering PYUSD stablecoin, which holds a valuation of approximately $327 million. In addition, Visa has enabled USDC as a native settlement currency on its network, because stablecoin payments are instantaneous, almost at no cost. This could be why Stripe has announced that it is allowing merchants using its platform to accept stablecoins for online transactions. Even MoneyGram has created on and off ramps for USDC in all of its locations around the world.

Even the banking sector, including Sygnum Bank, has tokenized $50 million worth of Matter Lab’s treasure reserves. The Sygnum-issued security tokens act as on-chain representations of units from Fidelity International’s (“Fidelity”) USD 6.9bn Institutional Liquidity Fund (ILF) to generate a secure and transparent “Proof-of-Reserves.”

This is where Pravica comes in. S3.Money is a solution that caters not only to up-and-coming stablecoin issuers such as central banks, retail banks, and DeFi (Decentralized Finance) projects, but also caters to existing stablecoin issuers, including the creators of Tether (USDT), Circle (USDC), by offering them the ability to simplify, quickly issue, manage, and create different treasury layers for their respective stablecoins.

The need for players such as Pravica is even more pressing given the current move by governments towards regulating stablecoins. The most recent is the Lummis-Gillibrand stablecoin bill on April 17, 2024. The result is that the Fed would have the power to decide which banks are allowed to issue stablecoins, as well as to exclude non-bank issuers from competing with those banks.

Numerous international bodies, such as the International Monetary Fund, Financial Stability Board, Financial Action Task Force, Basel Committee on Banking Supervision, and International Organization of Securities Commissions, also have policies on stablecoins that they hope to advance.

From July 2024, stablecoin issuers in the EU, or those issuing stablecoins linked to a currency of an EU member state, will be captured by the Markets in Crypto Assets (MiCA) regulations.

The advent of regulation means that stablecoin issuers will have to be extra careful with technology and cyber security requirements, as well as the ability to track real stablecoin transactions, which is usually a complex task. With S3, issuers are able to maintain the stablecoin ecosystem through S3’s intuitive management dashboard. The dashboard monitors supply and demand in real-time, tracking transactions easily and allowing for adjustments along the way.

Audits and compliance will take priority, and this has also been accounted for in S3 Money. The platform enhances treasury command with built-in proof-of-reserve functionality and seamless integration with on-chain oracles. Integrated KYC/AML features prioritize compliance, strengthening due diligence with qualified identity verification services.

So, for those who are ready to enter the world of stablecoins and CBDCs, Pravica is already there and waiting.